MeetingNotes AI

Turn spoken conversations into structured data and automated workflows instantly.

Ready to help

Turn spoken conversations into structured data and automated workflows instantly.

Transform raw podcast audio into rankable SEO content and viral marketing assets.

The industry-standard animated sprite editor and pixel art tool for professional game developers.

Optimize your brand to get found first, trusted most, and chosen more often on local AI and traditional search.

The premier cloud-native ecosystem for creative coding, generative art, and digital arts education.

Visual marketing and creative solutions to help inspire buyers, sell homes faster, and get top dollar.

Transform complex documents into verifiable intelligence with AI-powered automation.

The AI-native Employee Experience Platform that connects the hardest to reach, from frontline to HQ.

The AI-driven CDP and Marketing Automation engine that bridges the gap between customer data and commerce outcomes.

A video creation platform that has shut down.

Elevate your email marketing with design-centric automation and high-performance deliverability for mid-market brands.

The premier tech-driven real estate platform for instant cash offers and streamlined home selling.

Enterprise-grade conversational AI combining high-precision machine learning with human-in-the-loop adaptive understanding.

A super fast and privacy-focused app for managing your finances with envelope budgeting.

Deeply integrated AI powered by the IntelliJ platform's semantic code understanding.

A simple, flexible, and comprehensive OpenAI Gym environment for trading algorithms.

Transform natural language into production-ready SQL and real-time data visualizations.

The real estate industry's leading all-in-one transaction management and e-signature ecosystem.

Transform conceptual prompts into conversion-optimized e-commerce storefronts in minutes.

Open-source 2D animation software for creating film-quality animation.

The user-friendly command line shell with intelligent autosuggestions and syntax highlighting out of the box.

AI-powered visualization app for design ideation and refinement.

AI-powered bespoke tattoo design generator for custom, stencil-ready ink concepts.

Advanced B2B Matchmaking and High-Stakes Event Lead Generation

The open standard for clinical-grade mobile health data interoperability.

The unified API for accessing data and intelligence in the Microsoft Cloud.

A secure, cloud-based diabetes management system.

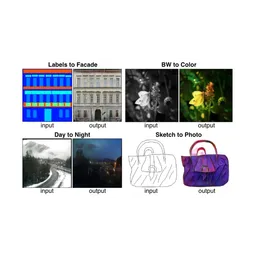

General-purpose solution to image-to-image translation problems using conditional adversarial networks.

The premier open-source P2P protocol for decentralized file discovery and historical archival.

Real-time AI voice changer and soundboard for gamers, streamers, and content creators.

Unified commerce solutions for home furnishings retailers.

The AI-driven lead conversion and growth platform for local service businesses.

The collaborative social media management platform for brand success and team efficiency.

The leading customer engagement platform for cross-channel orchestration and real-time AI-driven personalization.

A visual data science platform combining visual analytics, data science, and data wrangling.

The all-in-one AI design suite for architecture, interiors, and fashion visualization.

Reinventing the financial experience through hyper-personalized AI and cloud-native infrastructure.

The Medical Guidance Platform for smart triage and automated patient intake.

Fast DVD ripping and backup software with GPU acceleration.

Professional AI-powered image and video enhancement for high-fidelity content restoration.

The autonomous AI cloud scheduler that eliminates the back-and-forth of meeting coordination.

Deploy and scale state-of-the-art open-source avatar generation models on demand.

The brand templates platform that combines desktop publishing with brand automation.

The ultimate social media marketing platform for influencer auditing, engagement tracking, and competitor benchmarking.

The full-stack platform for the Generative AI lifecycle, spanning computer vision, NLP, and LLM orchestration.

The enterprise-enabled dynamic web vulnerability scanner.

Advanced AI-driven semantic rewriting for enterprise-grade content optimization and plagiarism avoidance.

Empowering Edge AI with high-efficiency reconfigurable NPUs and decentralized AI platforms.

Transform your personal identity into stunning AI-generated art with precision fine-tuning.

Transform complex documents, YouTube videos, and messy notes into structured visual intelligence.