JabRef

The open-source bibliographic integrity engine for detecting AI-hallucinated citations and paper-mill patterns.

Ready to help

The open-source bibliographic integrity engine for detecting AI-hallucinated citations and paper-mill patterns.

Embrace 'Slow Tech' with AI-driven analog film simulation and intentional development latency.

Enterprise-grade document translation with 100% layout and formatting preservation.

The website building platform for designers, developers, and marketers, offering complete creative freedom and advanced development tools.

A connected platform delivering innovation in AI, CPQ, CLM, and Document Automation.

Edit videos up to 5.5x faster by automatically removing silence, filler words, and bad takes with waveform precision.

A real-time social media dashboard application for tracking and organizing Twitter (X) accounts.

The observability platform that combines monitoring, incident management, and status pages into a single, developer-friendly interface.

Empowering workforces through education benefits and skilling programs to drive talent resilience and business growth.

Enterprise-grade eDiscovery and AI-powered legal intelligence for complex litigation and data recovery.

Ultra-high quality virtual try-on for any clothing and any person.

The complete solution to take care of your social media profiles.

Regnskabsplatform with tools to streamline accounting, automation and financial control for businesses.

LLM & SERP tracking for agencies & big brands, making large-scale SEO & GEO look easy.

The AI-powered HMO alternative providing 24/7 virtual primary and mental healthcare.

The modular, accessible, and high-performance code editor for the modern web.

A Deep Domain Conversational AI Platform for Building Industrial-Grade Assistants

The community-powered hub for hyper-realistic voice synthesis and deepfake lip-syncing.

Recover lost revenue, scale advertising, and reduce manual work with automated solutions and expert support.

The high-performance, enterprise-grade PDF productivity and eSign alternative to Adobe Acrobat.

Real-time face swap for PC streaming or video calls.

Multiply your content output with AI-driven video repurposing and contextual subtitling.

The industry-standard Pythonic framework for programmatic video editing and non-linear compositing.

AI-Powered Personal Health Assistant for Medical Insight & Human Expert Second Opinions

AI-powered bot protection for websites, mobile apps, and APIs.

The #1 email tracking extension for Gmail providing real-time read receipts and document analytics.

Distribute your music globally for free and keep 100% of your royalties.

Guiding you through 5,000 years of astrology.

A plug-and-play module turning community text-to-image models into animation generators without additional training.

The ubiquitous cross-platform API for hardware-accelerated 2D and 3D graphics rendering.

Professional, human-centric custom logo design for startups and small businesses.

A tool for generating API documentation in HTML format from doc comments in source code.

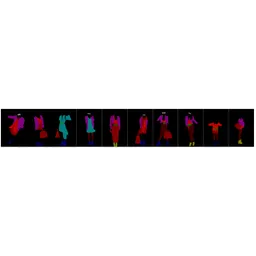

A large-scale street fashion dataset with polygon annotations for computer vision research.

Imagine, create, and play together with millions of players across an infinite variety of immersive, user-generated 3D worlds.

The robust, Haskell-driven static site library for developer-centric content ecosystems.

The only CRM natively built for Google Workspace, eliminating manual data entry through AI-driven relationship intelligence.

The most flexible free-form visual website builder for high-conversion design and e-commerce.

The leading European AI content suite for performance-driven marketing teams.

AI-powered performance monitoring and Core Web Vitals automation for sub-second page loads.

AI-Powered Compliance and Financial Cloud for Modern Enterprises and Individuals.

A unique drum and percussion synthesizer combined with a pattern-based drum-machine engine.

Building AI to simulate the world through generative video, images, and world models.

Personalized coaching and training platform for employee development, engagement, and performance.

Creating general-purpose humanoid robots to solve labor shortages.

Humanizes AI-generated content to achieve a 100% human score.

The intelligence platform for real estate developers to maximize project returns through automated data and predictive analytics.

Comprehensive SEO and content optimization tools.

The industry-standard search engine and metadata API for the global podcast ecosystem.

Professional-grade video transcoding with hardware-accelerated processing and multi-format support.